If you have driven on any city or suburban street or highway, parked in any public parking lot or the parking lots for a grocery store, department store, restaurant or “erotic dancing club,” or left your car on the driveway instead of inside the garage, your license plate has been scanned, time-stamped and recorded in a server. One such repossession company boasts that it captures 250,000,000 license plate scans each month and adds to its billions and billions of license plate scans in its database.

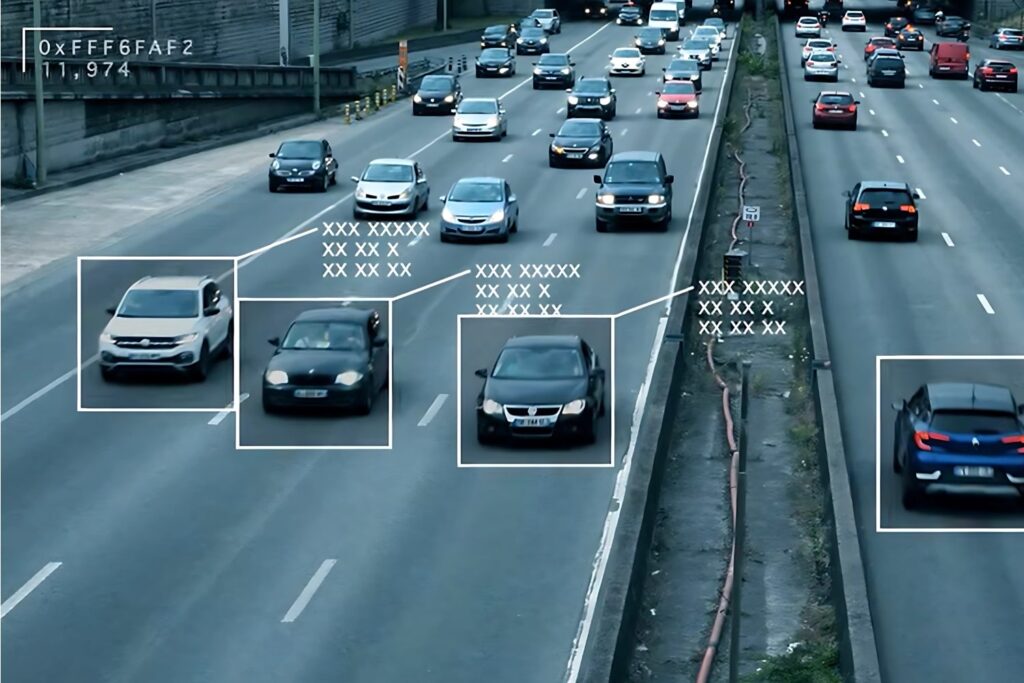

With AI, a simple search request will instantly gather the data on every location that your license plate was seen—driven past or parked. The license plate scanning industry will change surveillance, divorce law, personal injury rehabilitation confirmation, workers compensation questioning whether the employee is actually recovering at home, as well as the repossession of vehicles from “delinquent” borrowers.

All the owner of the software, license plate scan database and AI needs is your license plate number, and their fee paid.

Are you ok with that? Your privacy being recorded everywhere? Can you imagine “dark internet pirates holding you hostage because your vehicle was parked near an “erotic dance club,” a “cannabis dispensary,” a parking lot where “protestors of various views divergent from the mainstream,” places of “high drug trafficking,” or nightclubs that are known for “illicit activities.”

We are not yet at the point where just anyone can check on the location of your client’s vehicle location, but that is on the horizon. Can you imagine a disgruntled spouse checking where the pick-up truck traveled and parked?

Today, several Repossession servicing companies boast that they can obtain quicker and faster repossessions by the use of their license plate scans, their license plate scan database and AI.

We found the “fly in the ointment” in one recent lawsuit and sued the repossession servicing company for failing to verify that the lien holder was on title yet ordered the towing of our client’s vehicle. It will be months before the court rules while that repossession servicing company captures a billion more scans and sends out thousands of repossession assignments with vehicles towed away with a failure in its verification procedure.

Repossession servicing companies, repossession agents, tow truck operators and financial institutions depend on precise identification data to recover vehicles from borrowers who have defaulted on their vehicle loans. A mistake at any point in the repossession process can result in a lawsuit for a wrongful repossessions.

By integrating license plate scans with vehicle registration records, GPS tracking systems, and skip tracing methods, repossession servicing companies and their agents have shortened the time between obtaining a “repossession assignment” to the actual “recovery of the vehicle.” As technology continues to evolve, innovations such as Automated License Plate Recognition (ALPR) systems, AI and data-driven analytics will reshape how vehicles are identified and recovered, making the process faster, more reliable, and legally compliant.

This article explores the importance of license plate verification, examine key technological advancements, and discusses the best practices for retrieving and analyzing license plate data in repossession efforts.

The Importance of License Plate Verification

When repossessing vehicles, it is critically important that the process be precise, compliance with each and every pre-repossession element in the procedure and avoidance of any “breach of the peace.” Every repossession must comply with the law and to do otherwise is non-negotiable.

With millions of vehicles on the road, ensuring that the right vehicle is recovered is crucial to avoiding wrongful repossessions, costly legal disputes, and maintaining industry credibility. But so is making sure that the title reflects that the lien holder and the State registration and title are current as well. Hence, repossession servicing companies must verify each and every step before sending out two trucks to accurately identify and recover vehicles tied to delinquent loans.

Errors in the repossession process, such as failing to verify who is on title and who is not—the ownership of the vehicle—as well as the status of the lien holder on the vehicle, can lead to significant legal and financial consequences. These types of mistakes emphasize the need for careful and systematic verification, highlighting the critical role of tools like license plate scans to verification of the title and vehicle registration in reducing risks and ensuring compliance.

Preventing Wrongful Repossessions and Legal Consequences

One of the most significant risks in vehicle repossession is wrongful recovery. Such errors can lead to lawsuits, financial penalties, and reputational damage for both repossession servicing companies, agencies and financial institutions. A simple verification mistake can result in serious legal consequences, making a reliable verification system indispensable.

Without proper verification of vehicle ownership and lien status, agents may inadvertently repossess a vehicle that is not subject to recovery ever, or at the very least, subject to an additional legal process which requires notice and quite possibly litigation. However, that step should slow or terminate repossession and wrongful repossessions should become a thing of the past.

By leveraging license plate verification, agents cross-check multiple data points, such as vehicle identification numbers (VINs), registered owner information, title databases for owner and lien holder verification, and vehicle history records, to ensure that they are recovering the vehicle properly. This multi-layered approach reduces the likelihood of errors and enhances compliance with state and federal regulations governing repossession practices.

Enhancing Efficiency in the Repossession Process

For repossession servicing companies and lending institutions, “time” is a critical factor in vehicle repossession. According to them, “every additional hour spent searching for a vehicle drives up operational costs, prolongs case resolution, and impacts overall recovery success rates.” For the legal community representing consumers, license plate verification must be done correctly without skipping any of the verification steps and complying with state law before and during the recovering of vehicles.

We have found that the new repossession servicing companies and agencies now use automated verification systems that provide real-time access to updated license plate records, financial statuses, and GPS tracking data. Again, according to these repossession servicing companies, this access to AI and a “technology-driven approach ensures that agents swiftly locate and secure vehicles, ultimately improving both productivity and cost efficiency.”

Multi-Layered Verification for Maximum Accuracy

Today’s repossession servicing companies and agencies must use various integrated procedures to have a “proper and legal” repossession. Advanced verification techniques require repossession servicing companies and agencies to integrate various data points before sending out an order to repossess any vehicle. These additional verification measures and techniques should include:

- Cross-referencing with VIN records to confirm the vehicle’s unique identity.

- Checking registration status to verify whether the vehicle is still actively owned by the delinquent borrower.

- Checking registration status to verify whether the vehicle is owned by someone else.

- Checking the title to discover who is “on title” on the vehicle as owner.

- Checking the title to discover who is “on title” on the vehicle as lien holder.

- Making sure that the vehicle is not in a place that will result in a “breach of the peace.”

- Utilizing location data that has not violated constitutional protections of privacy.

By integrating these data points correctly and properly BEFORE assigning out a repossession assignment, the repossession servicing companies and agents will reduce the risk of repossession failures.

Technological Advances in License Plate Recognition

The auto repossession industry has witnessed a significant transformation over the past decade, largely due to technological advancements in License Plate Recognition (LPR). According to the industry, these innovations “have streamlined the repossession process, making it more efficient, accurate, and legally compliant. Today’s repossession agents rely on a combination of high-speed cameras, AI-driven analytics, and cloud-based data systems to identify and track vehicles in real time.”

The Role of Automated License Plate Recognition (ALPR) Systems

Automated License Plate Recognition (ALPR) has become a game-changer in the repossession industry. ALPR technology consists of high-resolution cameras and optical character recognition (OCR) software that can scan thousands of license plates within seconds. These systems are mounted on tow trucks, fixed surveillance points, and mobile recovery units, allowing the repossession industry agents to store millions and millions of license plate scans in plate scan databases.

According to the industry, the key benefits of ALPR include:

- High-speed scanning that allows processing of thousands of license plates per minute, significantly increasing efficiency.

- Real-time data processing that instantly cross-references scanned plates with repossession databases.

- Weather and low-light adaptability to ensure accuracy under challenging conditions.

- Minimized human error by automating the verification process and preventing wrongful repossessions. [However, this is where lawyers will focus on the removal of the human agent verification whether all the data is consistent with the formalities for the repossession assignment to issue in the first place.]

Cloud-Based Data Integration for Smarter Repossessions

According to the industry, one of the most notable advancements in license plate verification is “the integration of ALPR technology with cloud-based data systems. Repossession agents can now remotely access real-time vehicle data, enhancing collaboration between lenders, recovery agencies, and law enforcement.”

- Agents receive instant alerts when a vehicle of interest is detected.

- Data can be accessed from any location, enabling faster decision-making.

- Centralized databases ensure updated and synchronized information, reducing the chances of outdated or incorrect records.

- It is critical, therefore, before any vehicle identification number is entered into the system, that the legal pre-requisites are verified.

AI and Machine Learning in License Plate Verification

The future of license plate verification is being transformed by artificial intelligence (AI) and machine learning (ML), enhancing both accuracy and operational efficiency. Again, according to the industry, “these advancements are improving Automated License Plate Recognition (ALPR) systems, making them more adaptable and precise under various conditions”:

- “Predictive Analytics: AI-driven systems analyze vehicle movement patterns, helping agents anticipate and locate vehicles more efficiently.”

- “Enhanced Pattern Recognition: Machine learning algorithms improve accuracy, even when plates are partially obstructed or worn.”

- “Fraud Detection & Prevention: AI can identify discrepancies in vehicle records, reducing fraudulent repossession attempts and ensuring compliance.”

As AI-driven verification tools continue to advance, the repossession servicing agencies hope to experience higher success rates, but the legal community representing consumers hold the repossession servicing agencies that their methods and procedures remain both ethical and legally sound.

Secure and Compliant Data Handling in License Plate Verification

With the rise of automated data collection in vehicle repossession, ensuring data security and legal compliance will also be more important than ever. License plate verification tools handle sensitive personal information, making secure data handling a critical responsibility for repossession agents and financial institutions. Can you imagine “dark internet pirates holding innocent people hostage because their vehicle was parked outside an “erotic dance club,” a “cannabis dispensary,” a parking lot where “protestors of various views divergent from the mainstream,” places of “high drug trafficking,” or nightclubs that are known for “illicit activities.”

We need to strengthen the regulations governing license plate recognition to include:

- Driver’s Privacy Protection Act (DPPA), which already restricts access to personal information obtained from state motor vehicle departments.

- Fair Debt Collection Practices Act (FDCPA), which ensures ethical repossession practices on both the Federal and State levels.

- State-specific data protection laws that require transparency in license plate tracking and data usage.

We should also require that repossession servicing companies and agencies implement:

- Encryption and secure storage of license plate records.

- Strict data retention policies to reduce privacy risks.

- Limited access control measures to restrict data usage to authorized personnel.

- Regular compliance audits to meet evolving legal standards.

Final Thoughts

License plate scans, license plate scan database repositories are here and actively a part of vehicle repossession. We must require accuracy, efficiency, and legal compliance. With AI, machine learning, and big data integration on the horizon, the next generation of verification tools will definitely make repossession efforts faster, but at what cost?

As the technology advances, we must require and prioritize data security, protect consumer privacy, and create greater compliance with privacy legal frameworks. By adapting to new innovations while maintaining ethical and legal standards, we will continue to check that practices remain compliant with current and future legal requirements.

Author

Mike Simkus

Attorney/Founder, FS CORPS